About Pensions

Pensions are important. You may think pensions are boring and irrelevant but when you stop working and need an income to fund your retirement lifestyle you will have wished you paid more attention and made better decisions.

Pensions are a tax-efficient way of saving into a pension pot which can be converted into an income when you retire.

My Retirement Toolbox is designed to make pensions interesting and less complicated so hopefully you will make the effort to get more involved and make better decisions.

In addition to your state pension you will probably have a workplace pension or a personal pension and you may have more than one of each. For instance, if you have worked for several different companies you will probably have a different workplace pension for each company. If you are self-employed or have made your own pension arrangements you may have personal pensions.

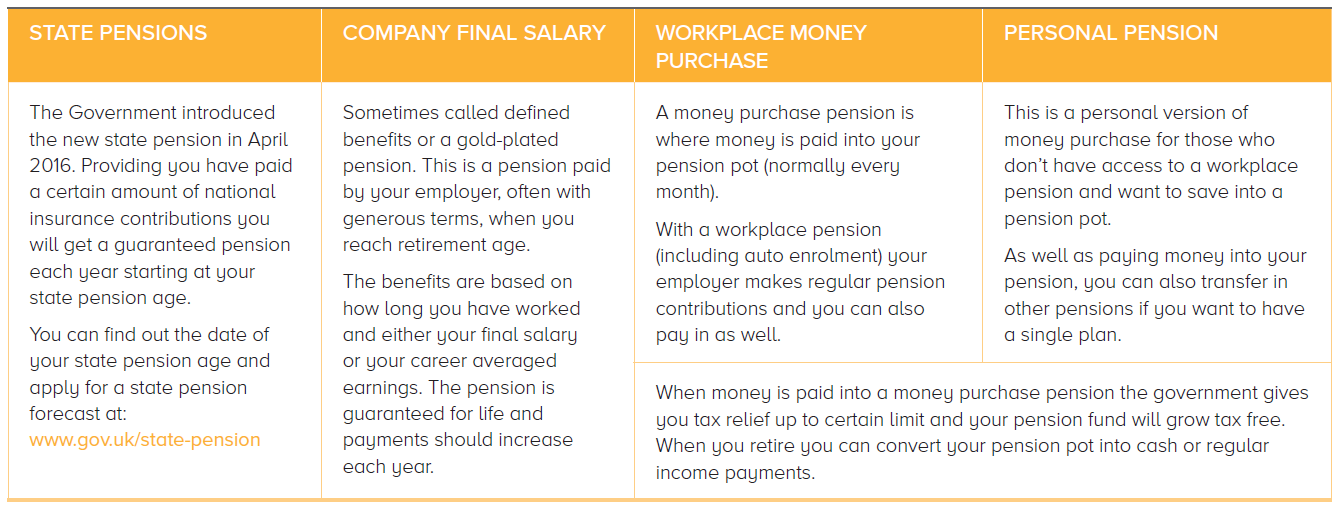

The different types of pensions are listed in the table below.

Pensions have the following advantages:

- Tax relief on contributions

- Tax privileged investment growth

- If you have a workplace pension your employer will make contributions

- If you are self-employed you invest some of your profits or income into a pension

- Access to your money at any time after age 75

For example for every £1,000 you contribute to your pension, the government will effectivle pay in £200 by way of tax relief. If you're a higher-rate tax payer in the UK, you can claim even more tax relief. How you’re taxed depends on your circumstances, though, and pension and tax rules could change.

There are some things to watch out for

- There is a limit of how much you can save tax-efficiently

- The value of investments may go down as well as rise in value

- When you retire you will tax on some of your income