Advice process

Investment advice for people with modest assets and uncomplicated circumstances is often a two-step process; the client explains what they want and completes a questionnaire and then the adviser uses their knowledge and judgement to recommend a solution.

Retirement advice is more complicated and often involves additional steps because there are more factors and solutions to take into account. These extra steps include educating clients about their options and the key issues, encouraging them to think about their longer-term objectives and equipping them with the tools to compare and contrast the options presented to them.

Another reason why retirement advice differs from many other areas of advice is that clients are generally more engaged and involved with the advice process because this is one of the most financial decisions, other than buying their house, they will ever make. Therefore, advisers need to make sure clients understand the key issues so they can play their part in the advice process.

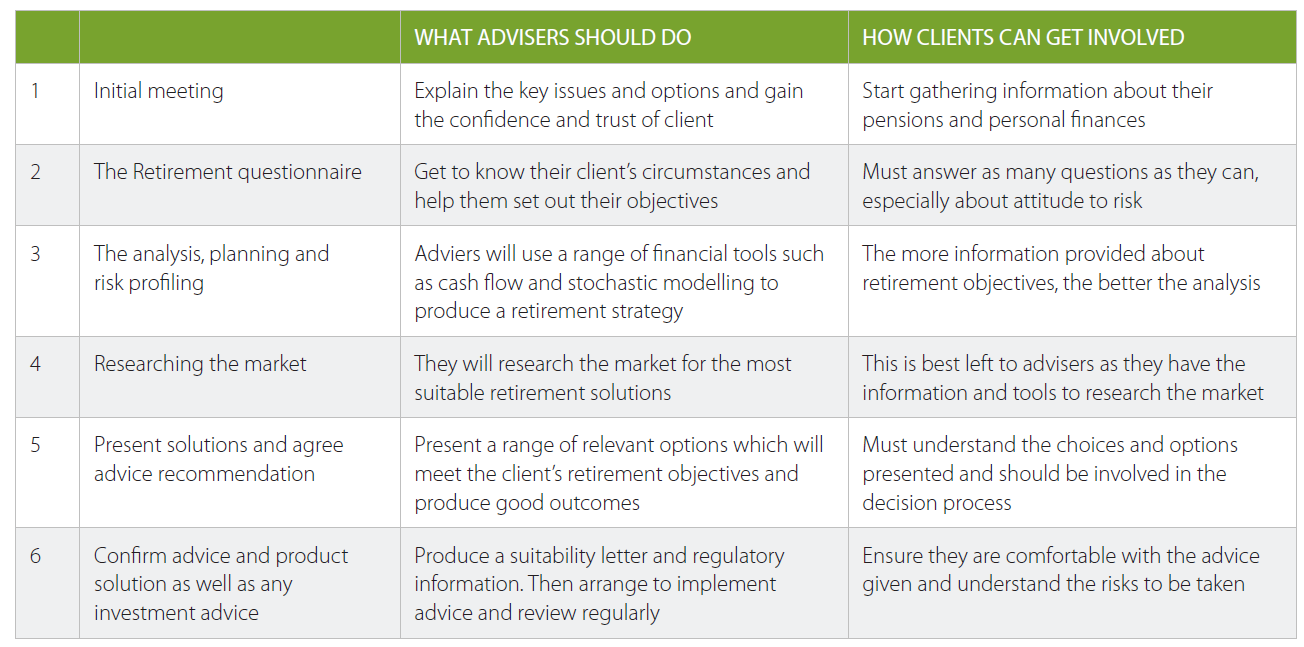

A typical advice process

The graphic below sets out the six stages of a typical advice process