Interest rates and annuities

Every time there is talk of an interest rate rise I am asked the question; “what will happen to annuity rates”?

My reply is always the same; “it all depends on what happens to bond yields”. By bond yields I mean the yield on gilts, corporate bonds and other fixed interest rate investments which insurance companies invest their annuity monies in.

Annuity companies invest in bonds

Annuity companies take your money, invest in safe and secure bonds and then pay you back your original capital plus interest for as long as you live.

The amount of interest paid depends on the yield from the bonds they invest in so the higher the yields the higher the annuity income.

Annuity companies don’t actually invest all their money in gilts as they can get higher returns from corporate bonds and property investments so the underlying rate of return for an annuity is much higher than the 15-year gilt. I calculate the underlying rate of return to be about 2%, i.e. about double the gilt yield.

If bond yields rise so will annuity rates, but by how much?

As a rule of thumb, if yields increase by a 100 basis points (e.g. from 1% to 2%) this should translate into about 8 to 10% increase in annuity rates.

The yield on 15-year gilts is a useful benchmark for annuity rates and this is quoted every day in the FT. Currently (5th November – Bondfire night!) the yield (which I call the benchmark yield) is 1.14% which is still at an historically low level.

The yield was at its lowest in summer 2020 when it fell to 0.5%. Before then the lowest point was after the 2016 EU referendum when the yield fell to 1%.

Annuity income

Turning from bond yields to annuities, the annual gross income from a £100,000 annuity, joint life 2/3rds for ages 65 and 60 with level payments is currently £ 4,141 per annum gross. I refer to this as benchmark annuity.

This compares to £ 3,861 in Summer 2020 and £ 3,823 after the 2016 referendum. This means the benchmark annuity is only £300 a year higher than the low point.

How will annuity rates increase if the bank rate increase?

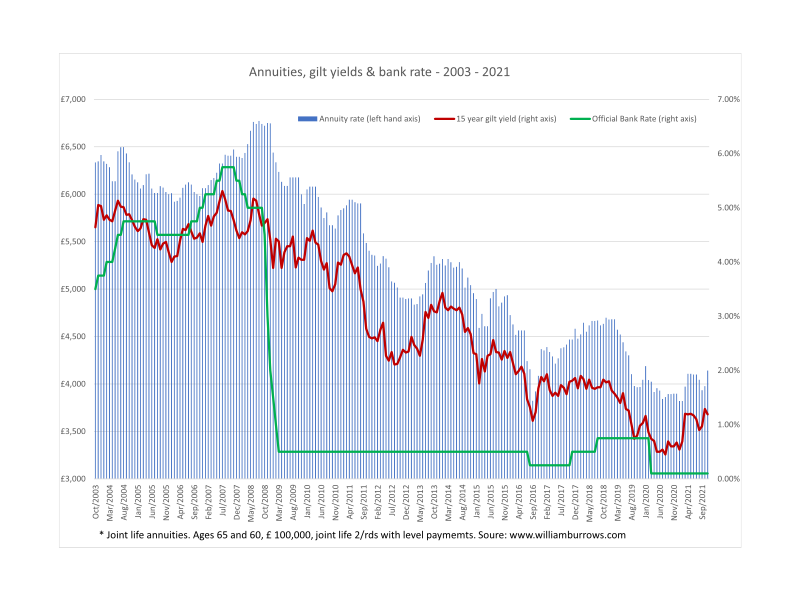

Using historical data, (see the chart below), we can see the official bank interest rate and gilt yields have been at historically low levels since the financial crash in 2008.

Before the 2008 crash, the bank rate was 5% and the 15-year gilt yield was also about 5% and the benchmark annuity was paying over £6,000 per annum gross.

This means annuity income was about 50% higher before the Bank of England started to cut interest rates and started printing money through ‘Quantitative Easing’.

It is probably optimistic (or pessimistic) to think that interest rates will increase to 5% again but they could increase by a few percentage points.

If interest rates were to increase to say 2.5% from the current extraordinary low level of 0.1%, we can expect annuity rates to increase by about 25% which would translate into about £ 5,000 per annum before tax for the benchmark annuity.

A word of warning; interest rates and bond yields no not necessarily move in tandem. As the chart shows there are times when interest rates fall much further than yields and vice versa. Therefore, it is important not to confuse short term interest rates will long term rates.

For example, it is possible that interest rates could increase by 1% and annuity income could jump to £5,000 or even £6,000 per annum.

Better value for money

Annuities have been accused of being very poor value. This accusation is untrue and misleading and there are a number of academic papers which demonstrate annuities are good value.

This is different to saying that the pay out from annuities is low, which they are because of the low yields.

As the income from annuities increases they should start to become more popular and considered to be offering better value.

Annuities will also compare more favourably with pension drawdown and therefore more people should convert their pension pots into guaranteed income rather than the take the risks associated with pension drawdown.

Conclusion

Annuity rates will rise if interest rates, but unless there is a significant increase in the bank rate, any increase will be measured in a few hundred pounds per annum. Whilst any rise is welcome, a rise of a few hundred pounds is unlikely to make annuities much more attractive in the short term.

However, if the increase is measured in thousands and the benchmark annuity increases to £5,000 or even £ 6,000, they should become much more popular and a hard act to beat.