Case for annuities

What is an annuity

An annuity is a policy which converts a capital lump sum (e.g. your pension pot) into guaranteed regular (monthly) income payments.

Lifetime annuities continue to pay an income for the rest of your life, no matter how long you live.

There also temporary or fixed-term annuities which only pay income for a set period of time.

Pension Annuities

The most popular annuities by far in the UK are pension annuities and these have the following characteristics:

- They pay an income for the rest of your life, no matter how long that is

- They are the only way of making sure you maximise your lifetime income without taking undue risks

- They are based on the principle of ‘mortality cross subsidy’

- Enhanced rates are available for those in poor health

- When you die income can continue to your spouse or partner

- If you die soon after taking your annuity a lump sum can be paid to your family

- Payments can remain level or increase each year

- You don’t have to arrange your annuity with your current pension provider – you can shop around for the highest paying annuity

Jane Austen wrote “An annuity is a very serious business” in Sense and Sensibility.

Mortality cross subsidy - makes annuities unique?

In order to meet the income for life promise, annuities are based on the concept of mortality cross subsidy.

Actuaries calculate annuity rates assuming people will live until their normal life expectancy but some policyholders will die before they are expected to and some will live longer than expected.

Insurance companies make a profit from those dying early and a loss from those living longer, but they use savings from the early deaths to subsidise the income paid to those who live longer than expected - This is called mortality cross subsidy.

Mortality cross subsidy is unique to annuities and clearly favours those in good health who may live longer than expected at the expense of those who die early.

To overcome this problem insurance companies offer enhanced annuities. Enhanced annuities pay a higher income for those who have a medical condition that may reduce their normal life expectancy (see section on enhanced annuities).

Calculating annuity rates

The person who purchases an annuity is called the annuitant, and the amount of income they receive depends on the following factors:

- The amount of money invested

- Age of policyholder and partner if a joint life annuity

- Anticipated life expectancy (taking health and lifestyle conditions into account)

- The underlying interest rate

- Options selected

See our annuity tables and quick quote calculator to see the current annuity rates

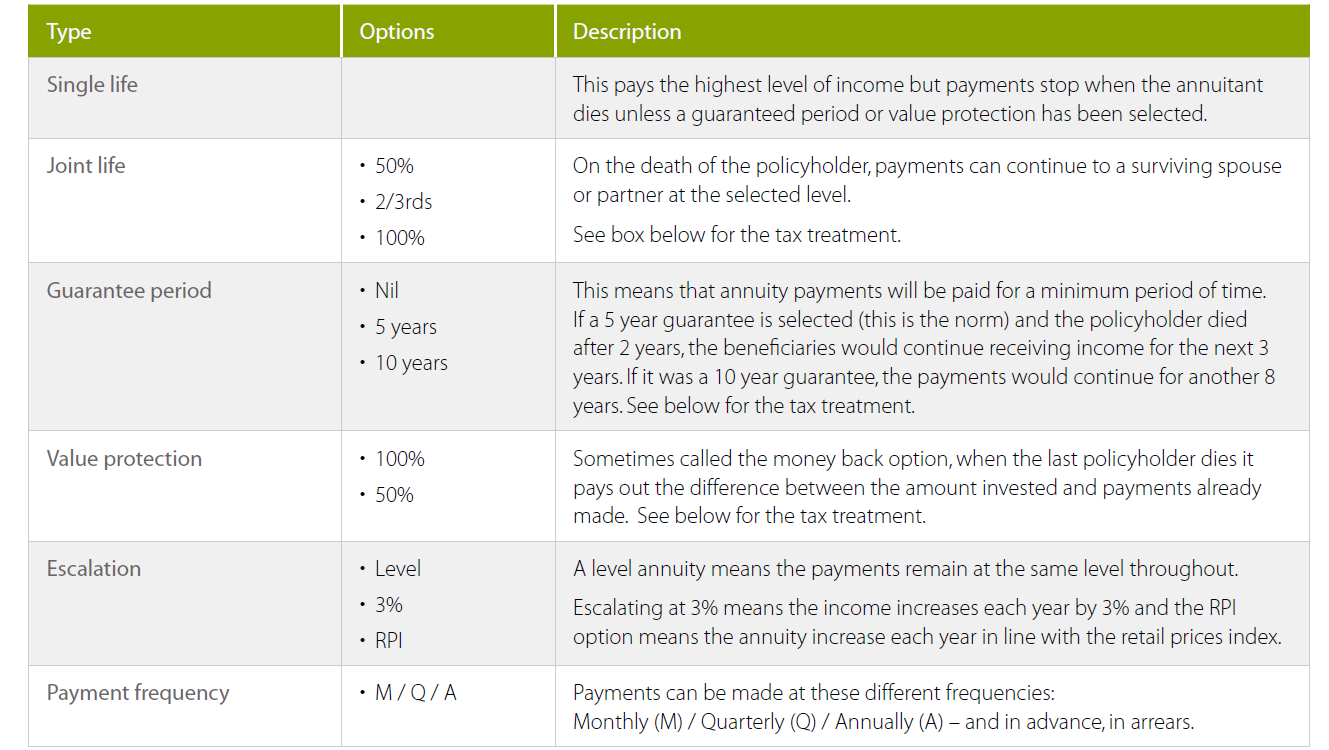

Annuity options

A basic annuity will stop making payments when the policyholder dies. In order to protect against the risk of losing out if the annuitant dies before getting a good return on the investment, or losing out to inflation, annuities have a number of options. These include; joint life, guaranteed income periods, value protection and escalation.

Tax: All income payments to the policyholder are taxed as income at their marginal rate. If the policyholder dies before age 75 any income or value protection payments paid to beneficiaries will be tax free. If the policyholder dies after age 75 any income paid to beneficiaries will be taxed at recipient’s marginal rate

Annuities are very safe – there is no investment risk

In the UK annuity policies are issued by life assurance companies which are regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

This means that annuities are highly regulated and insurance companies must ensure that they invest their annuity funds in safe funds so they can always meet their future annuity payments. Therefore, annuities are one of the few financial products that provide an income guarantee.

Conventional annuities are known as “non-profit” policies. This means that payments are guaranteed as long as the company is solvent because there is no investment risk. If an insurance company were to be declared insolvent and was unable to pay annuity payments, policyholders are protected by The Financial Services Compensation Scheme (FSCS).

FSCS will compensate annuitants 100% of the total value of the annuity.

Policyholder protection is triggered if an authorised insurer is unable, or likely to be unable, to meet claims against it, for example if it has been placed in provisional liquidation.

However, if you have an investment linked annuity e.g. with-profits, unit linked or flexible annuity, the payments are not guaranteed in the same way.

The case for annuities

The case for annuities can be made very simply; they are the only policy that can pay a high level of guaranteed income for life. In this sense an annuity is a pension, and in the rush to give people more choice it is easy to lose sight of why people save for a pension in the first place.

A more sophisticated case can be made because annuities meet the needs and objectives of people who want to make sure that they will have a regular income for the rest of their life with the peace of mind and security that they will never run out of income.

In order to argue the case for annuities I will consider the following:

- The advantages of annuitisation

- They provide insurance against outliving income

- They are the only policy that can pay a high level of guaranteed income for life especially for those with a medical condition*

- They meet the retirement objectives of many retired people

*While some commentators suggest the income from an annuity is not high, I will explain why I disagree.

1 The advantages of annuitisation

Economists, especially those in the US, have been interested in the concept of annuitisation (the process of converting a lump sum into income for life) for a long time and have argued that those who want to find the best way to stretch their income over their lifetime should purchase an annuity.

Ever since the US economist Menahem Yaari wrote about the life-cycle of a consumer with an unknown date of death but with the need to maximise income, annuities have played a central role in economic theory. Yaari showed how a consumer who did not need or want to leave money to the family, but wanted to get the maximum utility from their income, should annuitise their retirement savings.

If there were no annuities, people of pension age would be faced with two dilemmas when it came to taking an income from their pension pots;

- how much income to take

- where to invest their money.

Annuities solve this problem by guaranteeing a known amount of income as long as the policy holder (or their partner) is still alive.

Annuities solve this problem by providing an internal rate of return higher than cash but without any investment risk to the policyholder

| How much income to take? | Where to invest the money? | |

| If too much income was taken from their pension pots they would run the risk of running out of money but if they took too little income they could die without having enjoyed all the income they could have had. In economic terms, without annuities people will either over spend or underspend because it is almost impossible to arrange their finances so they die with a zero bank balance. | Without annuities, there would also be the problem of where to invest the capital. Investing in the stock market would put the capital at risk because it would fall in value if there was a stock market crash. However investing in cash or low yielding assets would provide a poor return on the money.? | |

| Annuities solve this problem by guaranteeing a known amount of income as long as the policy holder (or their partner) is still alive. | Annuities solve this problem by providing an internal rate of return higher than cash but without any investment risk to the policyholder |

2 Insurance against outliving income (but people underestimate how long they will live )

'In the long run we are all dead' said the famous economist John Maynard Keynes, but how long is the ‘long run’?

It is often much longer than people think because many grossly underestimating their life expectancy.

It is generally acknowledged that many people of pension age underestimate how long they will live by between 5 to 10 years. This may have serious consequences for those trying to organise their own retirement income plans because it increases the risk of running out of income in later life.

The table below sets out the average life expectancy for men and women.

As we will see later, one of the reasons some people do not like annuities is that they worry that if they die (and their partner if it is a joint life annuity) soon after taking out an annuity, the capital is gone and there is nothing to pass on to the rest of the family. However, the advantage of an annuity is that if someone lives well beyond their normal life expectancy, they will not outlive their income.

The annuity paradoxAcademic researchers, mainly in the US, use this term when they try and answer one of the most important questions in retirement income planning: Why, if annuities provide the optimum income payments for someone who wants to maximise their lifetime income without taking risk and ensures they do not outlive their income, do many people favour higher risk drawdown options? The answer to this riddle is twofold. First, many people are reluctant to make irrevocable decisions, and secondly there is a reluctance to choose an option that does not pay a lump sum to their heirs. |

3 A high level of guaranteed income for life, especially for those with a medica l condition

How high is a high income? The answer is higher enough to be more than on offer from other investments, but low enough to ensure that it can be guaranteed for life. At the time of writing, the annuity income for a 65 year old investing £100,000 in a single life policy was just over £4,600 per annum gross (September 2020). Put another away, it represents a return of 4.6% guaranteed.

Those with a keen eye for figures will spot that the reason why the return is so high is because annuity payments comprise part repayment of the original capital. Therefore it is not a like for like comparison with the income from an ISA or savings account. Never the less, there is no alternative that guarantees as high an income guaranteed for life.

Higher income for those in poor health

As we have seen, annuities are based on the principle of mortality cross subsidy and while this is good for those in good health who stand a good chance of beating the bet with the actuaries, they may not be such a good bet for those in poor health. To solve this problem, insurance companies offer enhanced annuities which pay out a higher income for those in poor health.

Those who smoke, take prescription medication or have been in hospital recently may be able to qualify for an enhanced annuity.

The table below compares the annuity income for a range of medical conditions.

You can get a higher income elsewhere but it may not be sustainable

The annuity critics are quick to point out the advantages of the alternatives such as pension drawdown or fixed term income plans where it is possible to take a higher income. This misses the point that an annuity pays a guaranteed income for life whereas the other polices (except unit-linked guarantees) do not guarantee an income for life and consequently the income could be less in the future.

Financial advisers point out the importance of ‘sustainable income’; i.e not only avoiding running out of income but ensuring that a certain level is maintained. An annuity is the only policy that ensures that a given level of income is sustainable. This means an enhanced annuity is still the best way for those in poor health to maximise and sustain their income for the rest of their life.

Strictly speaking, a sustainable income should increase in line with living expenses and an inflation-linked annuity does exactly that.

4 Meeting people’s retirement income needs

An essential part of retirement income planning is arranging an individual’s financial affairs to meet their longer term objectives. However, many people have difficulty in setting out their objectives and there are normally two reasons for this.

First of all is the tension between short term needs and requirements and longer term aspirations. For many people the short term need might be to have as much income as possible whereas the longer term aspiration might be to have an income that will help them maintain a certain standard of living with peace of mind and security.

Secondly, behavioural finance shows that most people value more money now as opposed to more money in the future.

|

Although everybody is different, everybody needs sufficient income every month in order to meet their everyday expenditure and maintain their standard of living. Therefore one of the most important retirement income planning questions is “Where will this income come from, both now and in the future”? |

Many people recognise the importance of having enough income throughout their retirement but often struggle to express exactly what their retirement income objectives are. For most people, income requirements may include:

- The need for a high level of income

- Guaranteed to be paid for the rest of their life

- To continue for their spouse, partner or dependents if they die first

- Not taking undue risk

In addition people will often express the need for flexibility as well as the need for guaranteed income. However flexibility and certainty are opposite sides of the coin. In most cases the best way to get certainty is with an annuity and the best way to get flexibility is probably through drawdown.