Salami Slicing

Do I have to take all of my tax-free cash in one go?

No you don't. You can spread your tax-free cash over a period of time.

There are a number of diffrent ways to phase your tax-free cash. One of the ways is called "Salami Slicing"

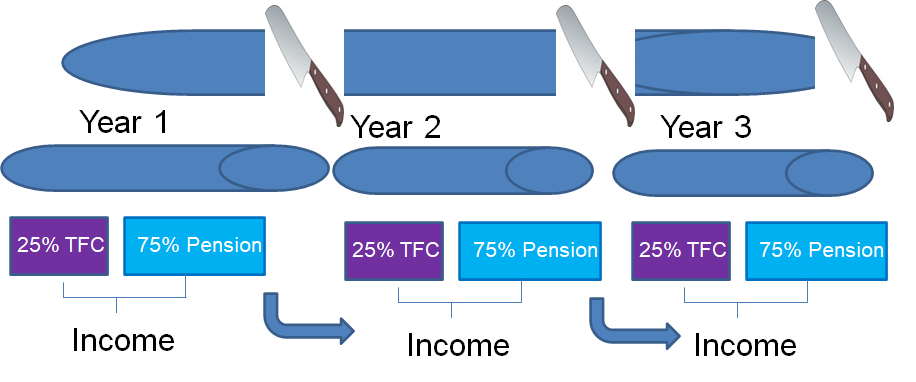

Salami Slicing

Think of your pension as a long salami – OK think of a £ 100,000 pension pot as being made up of 10 separate pots with £ 10,000 in each pot.

Instead of chopping off 25% of the salami and eating it (sorry, spending it) without giving any of it to the tax man, you can just chop of a slice of the salami (e.g. £ 10,000) and take 25% (£2,500) tax free.

Continuing with the salami theme, if you only eat a small amount of salami instead of a large amount, you may go hungry. In pension terms if you only take £2,500 of income instead of £25,000 you may not have enough cash or income.

Therefore, you can eat the remaining 75% of the pension salami but you will pay tax on this.

There are various ways to cut off your slices of salami and even though they have the same effect they have different names. Some options have many different names to make it even more complicated. These names include:

- Uffle puffle* – sorry, uncrystallised funds pension lump sum (UFPLS)

- Partial encashment

- Phased Retirment

Read more about Uncrystallised funds pension lump sum (UFPLS)